ITI 1220 Fall 2005 - Assignment 4

Available: Friday September 30

Due: Tuesday October 11, noon (NOTE:

Unusual day due to Thanksgiving holiday)

Instructions

This assignment is to be done in TEAMS OF TWO PEOPLE. The assignment should be submitted only once by a member of your team, but please ensure that the identification material contains the information for both team members. Follow the instructions in the lab manual for submitting assignments.

Your algorithms should be developed using the format used in class. Your algorithm traces should use the format shown in class; a separate table is to be used for each call to each algorithm. Programs should be based on the template file, and should follow good coding practices as described in the course lab manual.

Marking Scheme (total 100 marks)

- Regulations and Standards: 10 marks

- Question 1: 10 marks

- Question 2: 10 marks

- Question 3: 30 marks

- Question 4: 40 marks

Question 1 (10 marks)

In this question, you should use the algorithm format for Boolean expressions. Keep in mind the difference between a Boolean expression, and a test used in a branch or loop. You need only to write the expression (example: A ≤ (B + 3) ), and not a branch structure.

The Boolean expressions that you write for this question should use only the comparison operators (<, >, =, etc.), Boolean operators (AND, OR, NOT), and math operators +, –, ×, /, or MOD. Use parentheses where necessary.

Question 1a)

Student participants in the 2005 ACM intercollegiate

programming contest must satisfy the criteria listed below, based on the

following variables for a student: IsFullTimeStudent, PreviousContestParticipations, FirstUniversityYear,

Age, and NumberOfSemesters.

The eligibility criteria are:

- The variable IsFullTimeStudent must be true.

- The variable PreviousContestParticipations must be no larger than 5

- The variable FirstUniversityYear must be at least 2001. If this is not true, then the variable Age must be less than 24. If this is not true, then the variable NumberOfSemesters must be no greater than 8.

Write a Boolean expression that will be true if a student can participate in the contest, and false otherwise.

IsFullTimeStudent AND PreviousContestParticipations ≤

5 AND (FirstUniversityYear ≥ 2001 OR Age <

24 OR NumberOfSemesters ≤ 8)

Question 1b)

Suppose that you have three numbers A, B, and C, which are greater than zero. Write a Boolean expression that is true if any of the three numbers is evenly divisible by at least one of the other two numbers.

(A MOD B = 0) OR

(A MOD C = 0) OR (B MOD A = 0) OR (B MOD C = 0) OR (C MOD A = 0) OR (C MOD B =

0)

Question 2 (10 marks)

In this question, you should use the Java format for Boolean expressions. Keep in mind the difference between a Boolean expression, and a test used in an if statement. You need only to write the expression (example: A <= (B + 3) ), and not the complete if statement..

The Java Boolean expressions that you write for this question should use only the comparison operators (<, >, ==, etc.), logical operators (&&, ||, !), and math operators +, –, *, /, or %. Use parentheses where necessary.

Question 2a)

Suppose that day is an integer variable with value 1 through 7, where 1 represents Sunday, 2 represents Monday, and so on through to 7 representing Saturday. Another variable, hour, is an integer from 0 to 23. Finally, there is a Boolean variable holiday, which is true on days that are holidays.

The ITI 1220 professor is usually on campus from 10 a.m. until 7 p.m. on Mondays through Fridays, except on holidays. Write a Boolean expression that is true if the ITI 1220 professor would be on campus, and false otherwise.

(day >= 2 ) && (day <=6) && (hour >=

10) && (hour <= 19) && ! holiday

Question 2b)

The rules for passing the course ITI 1220/1620 are as follows:

- 25% of the assignment average + 20% of the midterm + 55% of the exam must be at least 50.0

- 20% of the midterm grade + 55% of the exam grade must be at least 37.5

Suppose that you have the variables assignAverage, midterm, and exam representing the corresponding values for a student and all three values are numbers between 0.0 and 100.0. Write a Boolean expression that will be true if the student passes the course, and false otherwise.

(0.25 * assignAverage + 0.2 * midterm + 0.55 * exam >= 50.0)

&& (0.2 * midterm + 0.55 * exam >= 37.5 )

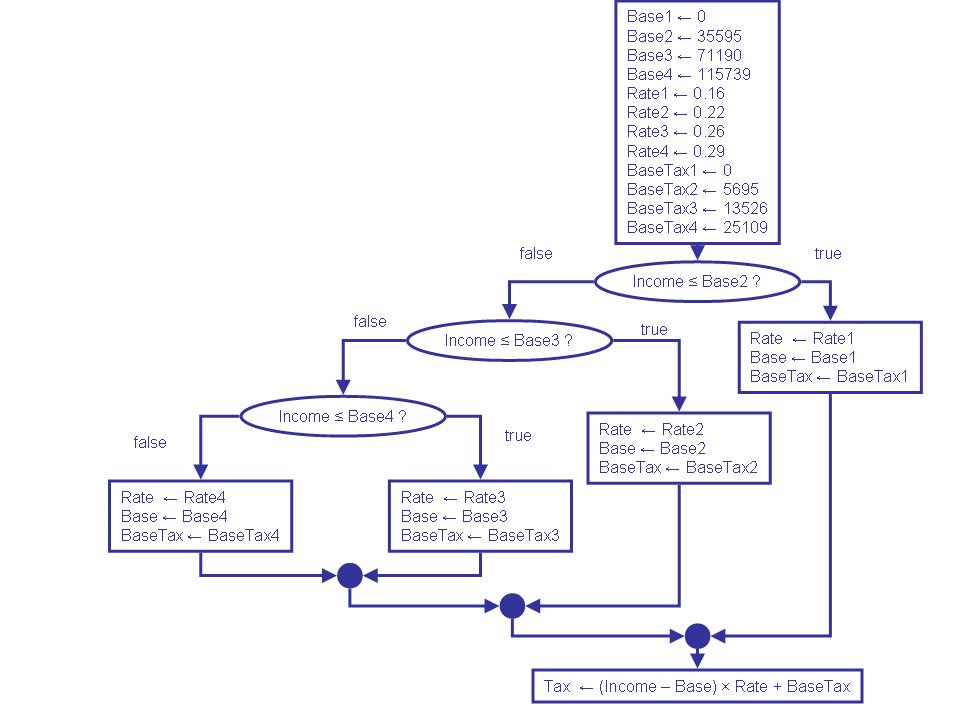

Question 3 (30 marks)

Implement the following algorithm in Java:

GIVENS:

Income (a person’s taxable

income, in dollars)

RESULTS:

Tax (amount

of federal tax)

HEADER:

Tax ← CalculateFederalTax( Income

)

ASSUMPTIONS:

Income is greater than or equal to

zero.

CONSTRAINTS:

Make

sure that Base1 through Base4 are increasing amounts.

INTERMEDIATES:

Base (base

amount for income bracket, line 2 of table)

Rate (tax

rate for income in excess of base amount, line 4 of table)

BaseTax (tax

on base amount, line 6 of table)

Base1 (CONSTANT: base amount in column 1)

Rate1 (CONSTANT: tax rate in column 1)

BaseTax1 (CONSTANT: base tax in column 1)

Base2 (CONSTANT: base amount in column 2)

Rate2 (CONSTANT: tax rate in column 2)

BaseTax2 (CONSTANT: base tax in column 2)

Base3 (CONSTANT: base amount in column 3)

Rate3 (CONSTANT: tax rate in column 3)

BaseTax3 (CONSTANT: base tax in column 3)

Base4 (CONSTANT: base amount in column 4)

Rate4 (CONSTANT: tax rate in column 4)

BaseTax4 (CONSTANT: base tax in column 4)

BODY:

// ITI 1220 Fall 2005, Assignment 4,

Question 3

// Name: Alan Williams, Student# 81069665

import java.util.Scanner;

/**

* This program calculates

the federal tax payable for a person with a specified

* taxable

income.

*/

class A3Q1a

{

public

static void main( String[] args )

{

// SET UP

KEYBOARD INPUT

Scanner

keyboard = new Scanner( System.in

);

// DECLARE

VARIABLES/DATA DICTIONARY

double income; // GIVEN: taxable income for a person

double tax; //

RESULT: amount of federal tax

double averageRate; //

RESULT: average rate of tax

double rate; //

INTERMEDIATE: the rate selected for the tax calculation

double base; //

INTERMEDIATE: the selected base amount

double baseTax; // INTERMEDIATE: tax on the selected base

amount

double rate1; //

INTERMEDIATE: (constant) tax rate for column 1 of tax table

double base1; //

INTERMEDIATE: (constant) base amount for column 1 of tax table

double baseTax1; //

INTERMEDIATE: (constant) tax on base amount for column 1 of tax table

double rate2; //

INTERMEDIATE: (constant) tax rate for column 2 of tax table

double base2; //

INTERMEDIATE: (constant) base amount for column 2 of tax table

double baseTax2; // INTERMEDIATE:

(constant) tax on base amount for column 2 of tax table

double rate3; //

INTERMEDIATE: (constant) tax rate for column 3 of tax table

double base3; //

INTERMEDIATE: (constant) base amount for column 3 of tax table

double baseTax3; //

INTERMEDIATE: (constant) tax on base amount for column 3 of tax table

double rate4; //

INTERMEDIATE: (constant) tax rate for column 4 of tax table

double base4; //

INTERMEDIATE: (constant) base amount for column 4 of tax table

double baseTax4; //

INTERMEDIATE: (constant) tax on base amount for column 4 of tax table

// PRINT OUT

IDENTIFICATION INFORMATION

System.out.println( );

System.out.println( "ITI 1220 Fall 2005, Assignment 4, Question 3"

);

System.out.println( "Name: Alan Williams, Student# 81069665" );

System.out.println( );

// READ IN

GIVENS

System.out.println( "Enter the taxable income." );

income = keyboard.nextDouble( );

// BODY OF

ALGORITHM

// Initialize

all the constants according to the tax table.

// Column 1

base1 = 0.0;

rate1 = 0.16; // Percentages

are expressed in 0 to 1 range.

baseTax1 = 0.0;

// Column 2

base2 =

35595.0;

rate2 = 0.22;

baseTax2 =

5695.0;

// Column 3

base3 =

71190.0;

rate3 = 0.26;

baseTax3 = 13526.0;

// Column 4

base4 =

115739.0;

rate4 = 0.29;

baseTax4 =

25109.0;

// Is income in first bracket?

if ( income <= base2 )

{

// Use column

1

base = base1;

rate = rate1;

baseTax = baseTax1;

}

else

{

// Is income in second bracket?

if ( income <= base3 )

{

//

Use column 2

base = base2;

rate = rate2;

baseTax = baseTax2;

}

else

{

// Is income in third bracket?

if ( income <= base4 )

{

// Use column

3

base = base3;

rate = rate3;

baseTax = baseTax3;

}

else

{

// Use column

4

base = base4;

rate = rate4;

baseTax = baseTax4;

}

}

}

// The above selected the values for 'base', 'rate', and 'baseTax'.

// Use the

selected values to calculate the tax.

tax = ( income - base ) * rate + baseTax;

// Determine average tax rate.

averageRate = tax / income;

// PRINT OUT

RESULTS AND MODIFIEDS

System.out.println( "The amount of tax is: " + tax );

System.out.println( "The average tax rate is: " + averageRate

);

}

}

Question 4 (40 marks)

A company records historical data for the amount of sales (measured in millions of dollars) of their products for each month. The sales amount for each month has already been stored in an array Sales, with length NumMonths. Note that the monthly sales record could extend for several years, and you should not assume the array has size 12.

The company’s management is interested in finding out whether the sales trend is good or not, and you have been asked to find the answer to the following question: What is the largest number of consecutive months for which sales have increased from one month to the next?

For example, suppose that for a period of 12 months previously, the sales were:

{5, 4, 6, 8, 8,

9, 11, 13, 12, 14, 15, 14}

The answer to the question would be 4 for the above sales figures, for the set of months with sales {8, 9, 11, 13}

Question 4a)

Design an algorithm that will determine the largest number of consecutive months for which sales have increased from one month to the next, using an array containing sales in millions of dollars.

GIVENS:

Sales (an array containing sales figures in

millions of dollars)

NumMonths (the length of the array Sales)

RESULT:

MaxStreak (maximum number of months with

consecutive sales increases)

ASSUMPTIONS:

The number of months in the result

counts the data points and not the number of intervals between them.

HEADER:

MaxStreak ←

SalesIncrease( Sales, NumMonths )

INTERMEDIATES:

Index (current array position)

CurrentStreak (current number of months for which sales has increased)

Question 4b)

Trace your algorithm on the following array of sales:

{12, 14, 13, 18,

19, 20, 19, 24}

|

# |

Statement |

Sales |

NumMonths |

MaxStreak |

Index |

CurrentStreak |

|

0 |

initial

values |

{12, 14,

13, 18, 19, 20, 19, 24} |

8 |

? |

? |

? |

|

1 |

Index ← 1 |

|

|

|

1 |

|

|

2 |

CurrentStreak ← 1 |

|

|

|

|

1 |

|

3 |

MaxStreak ← 1 |

|

|

1 |

|

|

|

4 |

Index < NumMonths : true |

|

|

|

|

|

|

5 |

Sales[Index] > Sales[Index-1] : true |

|

|

|

|

|

|

6 |

CurrentStreak ← CurrentStreak

+ 1 |

|

|

|

|

2 |

|

7 |

CurrentStreak > MaxStreak : true |

|

|

|

|

|

|

8 |

MaxStreak ← CurrentStreak |

|

|

2 |

|

|

|

10 |

Index ← Index +

1 |

|

|

|

2 |

|

|

4 |

Index < NumMonths : true |

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

11 |

CurrentStreak ← 1

|

|

|

|

|

1 |

|

10 |

Index ← Index +

1 |

|

|

|

3 |

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

2 |

|

7 |

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

10 |

|

|

|

|

4 |

|

|

4 |

Index < NumMonths : true |

|

|

|

|

|

|

5 |

Sales[Index] > Sales[Index-1] : true |

|

|

|

|

|

|

6 |

CurrentStreak ← CurrentStreak

+ 1 |

|

|

|

|

3 |

|

7 |

|

|

|

|

|

|

|

8 |

|

|

|

3 |

|

|

|

10 |

Index ← Index +

1 |

|

|

|

5 |

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

4 |

|

7 |

CurrentStreak > MaxStreak : true |

|

|

|

|

|

|

8 |

MaxStreak ← CurrentStreak |

|

|

4 |

|

|

|

10 |

|

|

|

|

6 |

|

|

4 |

|

|

|

|

|

|

|

5 |

Sales[Index] > Sales[Index-1] : false |

|

|

|

|

|

|

11 |

|

|

|

|

|

1 |

|

10 |

|

|

|

|

7 |

|

|

4 |

Index < NumMonths : true |

|

|

|

|

|

|

5 |

Sales[Index] > Sales[Index-1] : true |

|

|

|

|

|

|

6 |

CurrentStreak ← CurrentStreak

+ 1 |

|

|

|

|

2 |

|

7 |

CurrentStreak > MaxStreak : false |

|

|

|

|

|

|

9 |

Ć |

|

|

|

|

|

|

10 |

Index ← Index +

1 |

|

|

|

8 |

|

|

4 |

|

|

|

|

|

|